All Categories

Featured

Table of Contents

You can lose a whole lot of money and time utilizing data that is wrong or out of day. Individuals search software program will certainly offer greater high quality information for your service. Test BellesLink information on your own. When you intend to look a list of individuals, Batch Browse is the tool to make use of since you can can look thousands of documents simultaneously and returned thorough search engine result with present contact number, addresses, and emails.

Conserve time by browsing thousands of documents at one time, rather of specific searches. When you need to do a full search to locate get in touch with information for a specific, their relatives, neighbors and affiliates, you'll want to make use of individuals searches.

Data from your people searches can be saved right into a call record. In all the talk about data and searches, it's easy to fail to remember why organizations make use of people search tools in the first location, the reason is to make contact with the individual by phone, text, and email.

Government Tax Foreclosures List

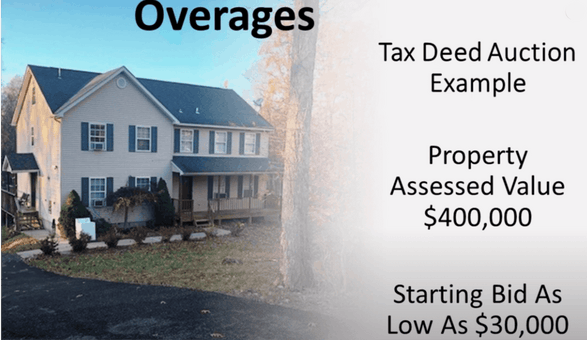

Every currently and after that, I hear speak about a "secret new opportunity" in the company of (a.k.a, "excess earnings," "overbids," "tax obligation sale surpluses," and so on). If you're entirely not familiar with this concept, I 'd such as to offer you a fast summary of what's taking place here. When a homeowner stops paying their real estate tax, the local municipality (i.e., the area) will wait for a time prior to they seize the building in repossession and offer it at their yearly tax sale public auction.

The details in this post can be influenced by lots of special variables. Intend you have a property worth $100,000.

Tax Sale Property Listing

At the time of repossession, you owe ready to the county. A few months later, the area brings this residential or commercial property to their yearly tax sale. Right here, they market your residential or commercial property (in addition to loads of various other delinquent properties) to the highest possible bidderall to redeem their lost tax obligation profits on each parcel.

Right here's the point: Your residential property is conveniently worth $100,000. In numerous cases, properties like your own will obtain proposals FAR past the amount of back taxes really owed.

State Tax Foreclosure

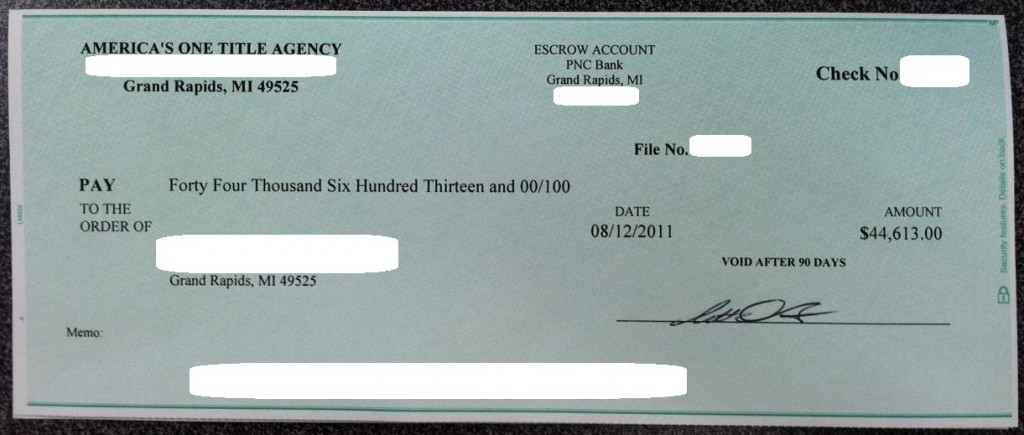

Get this: the county only needed $18,000 out of this property. The margin between the $18,000 they needed and the $40,000 they obtained is referred to as "excess earnings" (i.e., "tax obligation sales excess," "overbid," "surplus," etc). Lots of states have statutes that restrict the county from keeping the excess repayment for these residential properties.

The region has policies in location where these excess earnings can be asserted by their rightful proprietor, typically for an assigned period (which differs from state to state). And that specifically is the "rightful owner" of this cash? For the most part, it's YOU. That's ideal! If you shed your home to tax obligation foreclosure because you owed taxesand if that property ultimately marketed at the tax obligation sale public auction for over this amountyou can probably go and gather the distinction.

This consists of proving you were the prior owner, completing some documentation, and awaiting the funds to be provided. For the typical person that paid complete market worth for their home, this approach does not make much feeling. If you have a serious quantity of cash invested into a home, there's method also much on the line to just "let it go" on the off-chance that you can bleed some extra squander of it.

With the investing technique I utilize, I can acquire homes free and clear for dimes on the buck. When you can buy a residential property for a ridiculously affordable rate AND you recognize it's worth substantially more than you paid for it, it may extremely well make feeling for you to "roll the dice" and try to collect the excess profits that the tax foreclosure and public auction process create.

While it can absolutely pan out comparable to the means I've described it above, there are additionally a couple of drawbacks to the excess profits approach you really ought to know - tax property foreclosures. While it depends significantly on the characteristics of the property, it is (and sometimes, likely) that there will certainly be no excess earnings created at the tax obligation sale public auction

How To Stop A Tax Sale On Your Property

Or probably the region doesn't create much public rate of interest in their public auctions. In any case, if you're purchasing a home with the of allowing it go to tax obligation foreclosure so you can collect your excess proceeds, what if that money never comes with? Would it be worth the moment and money you will have thrown away once you reach this final thought? If you're expecting the region to "do all the job" for you, then guess what, Oftentimes, their timetable will actually take years to pan out.

The very first time I sought this technique in my home state, I was told that I really did not have the choice of asserting the surplus funds that were generated from the sale of my propertybecause my state didn't allow it. In states similar to this, when they produce a tax obligation sale excess at a public auction, They just maintain it! If you're thinking concerning utilizing this technique in your company, you'll desire to assume long and hard about where you're doing business and whether their legislations and statutes will certainly also permit you to do it.

Delinquent Tax Foreclosures

I did my finest to offer the correct response for each state over, however I would certainly advise that you before waging the assumption that I'm 100% proper. Keep in mind, I am not a lawyer or a CPA and I am not attempting to hand out expert legal or tax recommendations. Talk to your lawyer or CPA prior to you act on this info.

The reality is, there are thousands of auctions all around the country every year. This is partly why I've never been a substantial follower of tax obligation sale auctions.

Inspect its accuracy with a third-party professional prior to you get begun). (ideally, a couple of months from the repossession day, when motivated sellers are to dump their home for next-to-nothing costs).

IMPORTANT: You ought to NOT settle the overdue tax obligation equilibrium during your purchase procedure (you will probably have to accept a Quit Insurance Claim Deed instead of a Service warranty Deed for the property). Play the waiting game till the residential or commercial property has actually been foreclosed by the county and sold and the tax obligation sale.

Pursuing excess profits provides some pros and cons as a business. There can be some HUGE upside prospective if and when the celebrities straighten in your favorthey seriously need to in order to attain the best possible outcome.

Tax Defaulted Properties Sale

There is the opportunity that you will earn absolutely nothing in the long run. You may shed not just your cash (which hopefully won't be quite), yet you'll likewise shed your time also (which, in my mind, deserves a whole lot much more). Waiting to collect on tax obligation sale overages calls for a great deal of resting, waiting, and hoping for outcomes that typically have a 50/50 chance (generally) of panning out positively.

If this appears like a service chance you intend to dive right into (or at least discover more regarding), I understand of one individual that has actually developed a full-on course around this certain type of system. His name is and he has actually discovered this realm in terrific detail. I have actually been via a number of his programs in the past and have actually located his approaches to be highly efficient and legit money-making methods that function extremely well.

A Tax Obligation Sale Overages Business is the ideal business to run out of your home. If you are seeking a method to supplement your earnings, which can eventually become a permanent occupation, after that this could be for you. All you really require to start is a Home Workplace with the complying with things: Computer with Web Connection Printer Mobile Phone Miscellaneous Office SuppliesThis book will certainly stroll you through the process of beginning and running this sort of service, step-by-step, as well as, to talk about the most effective methods to set about obtaining these Tax obligation Sale Overages for your customers while obtaining paid for your initiatives.

Latest Posts

Delinquent Real Property

Investing In Tax Lien Certificates Online

Real Estate Tax Lien Investments For Tax Advantaged Returns